haven't filed taxes in 5 years what do i do

The CRA doesnt need some elaborate reason. The IRS doesnt pay old refunds.

40 Years Ago And Now From 70 To 30 Peak I T Rate

If you earned 18200 or less in the past financial year AND you had no tax withheld from that income you might not be required to lodge a tax return.

. As soon as you miss the tax deadline typically April 30 th each year for most people there is an automatic late filing penalty of 5 percent of the tax owing. If youre getting refunds and wont owe taxes you can focus on the last four years only as the statute of limitations prevents refunds beyond 3-4 years How do your tax professionals at Washington Tax Services handle this for. An original return claiming a refund must be filed within 3 years of its due date for a refund to be allowed in most instances.

Confirm that the IRS is looking for only six years of returns. Call the IRS or your tax pro can use a dedicated hotline to confirm the unfiled years. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for each full month your return is late to a maximum of 12 months.

For each year that you failed to file a tax return make sure you have your W-2 or Form 1099. If the IRS filed for you youll want to replace the Substitute for Returns with returns of your own to reduce the balance they assessed. If you havent filed your income tax this year or the previous years your best recourse is to file it as soon as possible.

26 April 2021 24 May 2020 by Matthew. If I havent filed taxes in 4 years and dont have any w2s or remember when or where I worked can you help me. You can only claim refunds for returns filed within three years of the due date of the return.

After the expiration of the three-year period the refund statute prevents the issuance of a refund check and the application of any credits including overpayments of estimated or withholding taxes to other tax years that are underpaid. For each month that you do not file you are charged another one percent. If you failed to pay youll also have 12 of 1 failure to pay penalty per month assessed against you.

That said youll want to contact them as soon as possible to explain the situation of your case. Then start working your way back to 2014. Input 0 or didnt file for your prior-year AGI.

You are not alone. If you know that you have not paid UK taxes in years the scary part is that HMRC can charge substantial penalties. If you cannot pay what you owe the state will seize your property.

The penalty charge will not exceed 25 of your total taxes owed. If you cant find this paperwork you can request a copy of. I do not remember one or two jobs i worked last year how do i find out or get all the tax forms from last year.

Just tell them the truth. This penalty is usually 5 of the unpaid taxes. Gather up all the paperwork you can find and make an appointment at your closest tax preparation office.

What do I do if I havent filed taxes in 5 years. Contact the CRA. If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good sign.

Everyone needs to either lodge a tax return or lodge a non-lodgment advice form. The state can also require you to pay your back taxes and it will place a lien on your property as a security until you pay. Theyll start with the oldest missed return and work their way forward.

I recently filed my 2019 taxes but they were rejected because the AGI I gave them didnt match with the number on my non-existent 2018 tax return. If you fail to file your taxes youll be assessed a failure to file penalty. Return to that part of the process in your software.

If you didnt file because you didnt owe taxes you could be leaving money on the table in the form of refundable tax credits such as. This does not mean you can ignore your taxes. The reasons for not filing your income tax do not matter to the process.

If you havent filed in years and the CRA has not yet contacted you about your late taxes apply to the Voluntary Disclosure Program as soon as possible. But if you filed your tax return 60 days after the due date or the extended due date then you might have a bigger penalty. This helps you avoid prosecution for tax evasion as well as penalties and interest fees for filing your tax returns late.

However you can still claim your refund for any returns from the past three years. Your penalty will now be the smaller of 135 or 100 of your total tax debt. 0 1 1103 Reply.

Havent Filed Taxes in 5 Years If You Are Due a Refund. Tax evasion in California is punishable by up to one year in county jail or state prison as well as fines of up to 20000. Dont let the IRS keep any.

This is because the CRA charges penalties for filing and paying taxes late. The IRS offers several tools and personal income tax resources including the Interactive Tax Assistant to get you started on the right track. What happens if you havent filed taxes in 5.

Everything before that is lost. In addition if you filed your taxes but did not pay the money that you. In fact you have 3 years to file to get your money back.

Its too late to claim your refund for returns due more than three years ago. I havent filed a tax return with HMRC Inland Revenue in years what do I do. This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months.

5 Items For Your Tax Preparation Checklist Ehow Tax Preparation Tax Prep Tax Deductions

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Pin On Healthy Freelance Living

Tax Return Status Online Income Tax Income Tax Return Tax Refund

Apply For Medicaid Snap Other Benefits Over The Phone Medicaid How To Apply How To Find Out

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

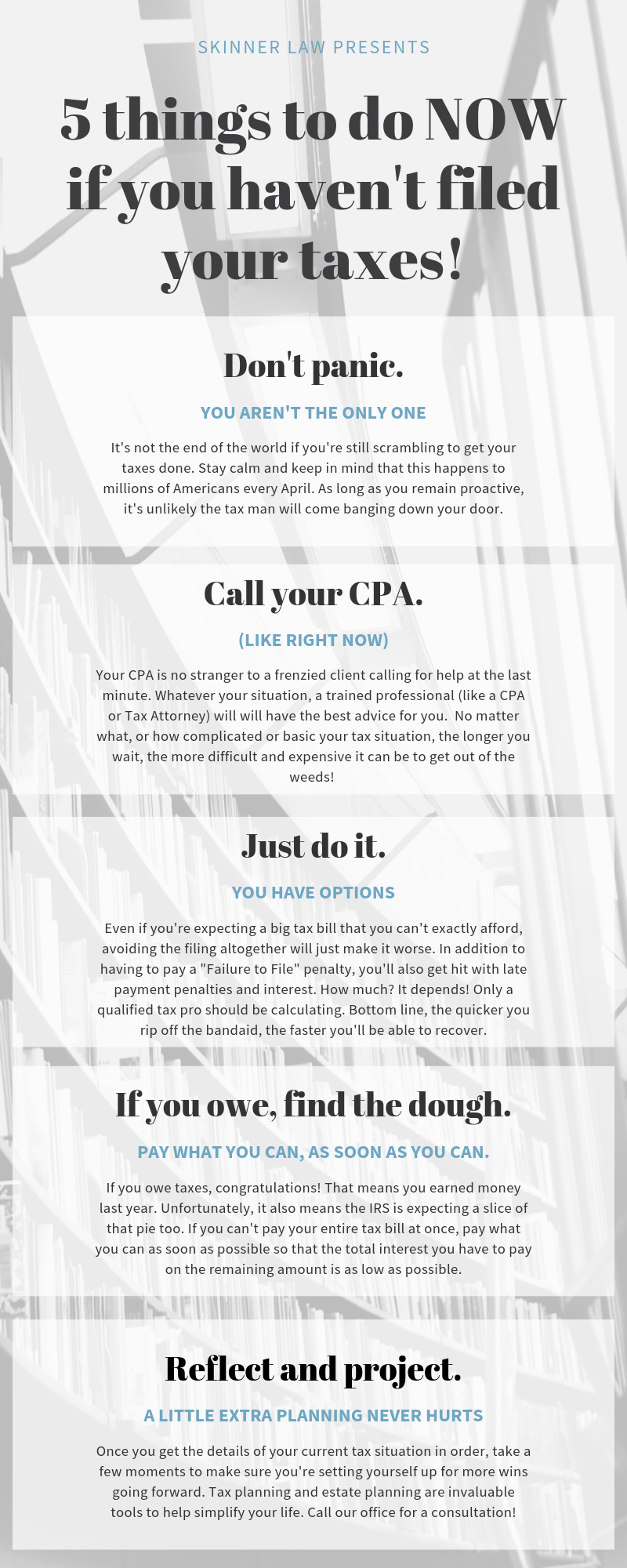

5 Things To Do If You Haven T Filed Your Taxes Infographic

I Haven T Filed Taxes In 10 Years Or More Am I In Trouble

12 Simple Money Management Tips You Can Start Today Filing Taxes Work Life Balance Tips Work Life Balance

I Haven T Filed Taxes In 5 Years Youtube

I Haven T Filed Taxes In 5 Years How Do I Start

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

I Haven T Filed Taxes In 5 Years How Do I Start

Export Benefits Accounting Taxation Income Tax Return Accounting Benefit

Haven T Filed Taxes In Years What You Should Do Youtube

F Y 2016 17 Due Dates Of Service Tax Tds Tcs Central Exxcise Cst Vat Pt Esic Pf

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

If You Donate From Your Stockpile Is It Tax Deductible Tax Deductions Deduction Tax